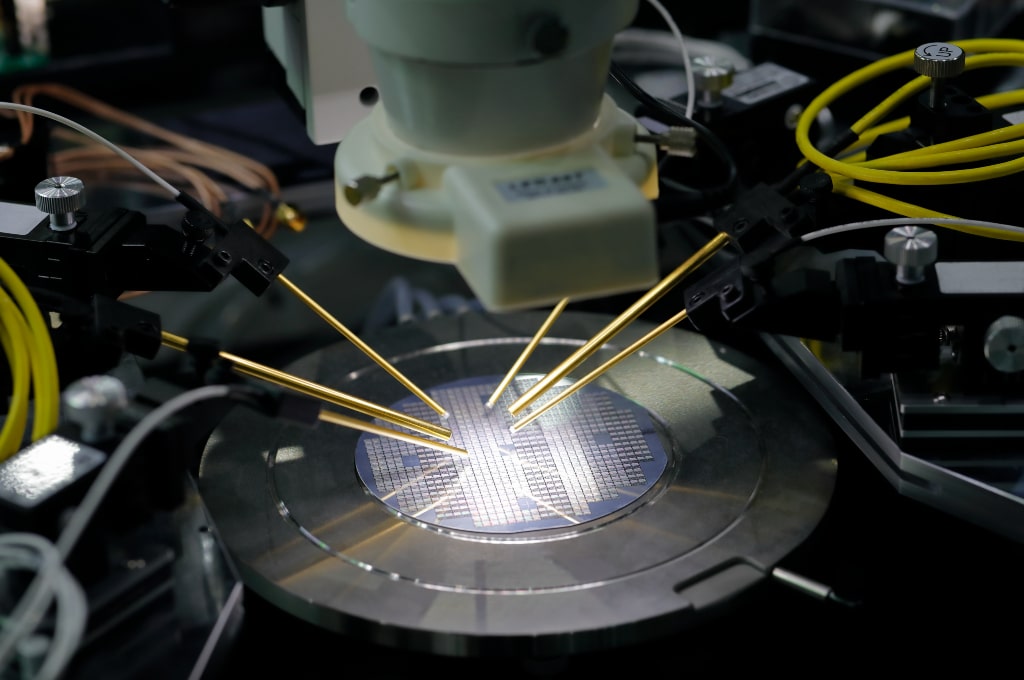

The current problem of the lack of semiconductors in industrial hardware

The dimension of the problem

The problem is such that automobile and medical device manufacturers have asked the current United States government to subsidize the construction of a new semiconductor manufacturing facility in the North American country. Likewise, the world’s largest semiconductor manufacturer in the world, located in Taiwan, has significantly increased its budget for 2021. The problem that still causes the bottleneck is that financing and building a new semiconductor factory can be a process of about five years.

To a large extent, this shortage has been a time bomb, building up since the end of last year due to some unrelated disruptions in the supply chain. When the Covid-19 pandemic caused a sharp drop in vehicle sales in the spring of 2020, automakers cut their orders for all parts and materials, including chips needed for functions ranging from touchscreens to systems for avoid accidents. Then in the third quarter, when demand for vehicles rebounded, chipmakers were already committed to supplying their large customers in consumer electronics and IT.

Geopolitical factors have also played an important role, especially in a particularly media case such as that of the Trump administration, strictly regulating semiconductor sales to Huawei and other Chinese companies. Those companies began stocking essential chips for 5G smartphones and other products. At the same time, US companies were excluded from chips made by the China International Semiconductor Manufacturing Corporation after the US federal government blacklisted Huawei.

In addition, in July, a fire in a Japanese factory cut off the supply of the special fiberglass used for printed circuit boards. Then, in October, a fire at a Japanese plant owned by Asahi Kasei Microdevices took out of circulation advanced detection devices used in the automotive and other industries. It was so devastating that the plant was still idle at the end of February.

As if all of the above were not enough, there have also been limitations in the global transportation system. About 7% of ocean freight has not left China’s ports during the first quarter of 2021. Container shortages forced companies to pay shipping premiums and demand shifted to air freight. But the problem has come as the air cargo system has seen increased demand due to global shipments of Covid-19 vaccines. In summary, the global air cargo capacity in the first quarter of 2021 has been 25% lower than last year.

Aggressive inventory practices have made many manufacturers vulnerable. As vehicle sales began to rebound in the third quarter, automakers were slow to order more semiconductors and lost ground to more agile electronics manufacturers that enjoyed greater visibility into the big picture and strong relationships with customers. semiconductor manufacturers. Electronics manufacturers planned accordingly and secured their supply lines by November 2020.

The auto industry is undergoing another critical market shift that has major supply chain implications: As automakers increasingly prioritize electric vehicles, cars are becoming electronic devices. This means that the automotive industry must now face the competitive demands of all other industries, including those in electronics and those that add Internet connectivity to their products. What has become clear as a lesson is that a flexible and agile supply chain is crucial to be able to move properly when sensitive changes occur and thus protect the business.]]>

To a large extent, this shortage has been a time bomb, building up since the end of last year due to some unrelated disruptions in the supply chain. When the Covid-19 pandemic caused a sharp drop in vehicle sales in the spring of 2020, automakers cut their orders for all parts and materials, including chips needed for functions ranging from touchscreens to systems for avoid accidents. Then in the third quarter, when demand for vehicles rebounded, chipmakers were already committed to supplying their large customers in consumer electronics and IT.

Geopolitical factors have also played an important role, especially in a particularly media case such as that of the Trump administration, strictly regulating semiconductor sales to Huawei and other Chinese companies. Those companies began stocking essential chips for 5G smartphones and other products. At the same time, US companies were excluded from chips made by the China International Semiconductor Manufacturing Corporation after the US federal government blacklisted Huawei.

In addition, in July, a fire in a Japanese factory cut off the supply of the special fiberglass used for printed circuit boards. Then, in October, a fire at a Japanese plant owned by Asahi Kasei Microdevices took out of circulation advanced detection devices used in the automotive and other industries. It was so devastating that the plant was still idle at the end of February.

As if all of the above were not enough, there have also been limitations in the global transportation system. About 7% of ocean freight has not left China’s ports during the first quarter of 2021. Container shortages forced companies to pay shipping premiums and demand shifted to air freight. But the problem has come as the air cargo system has seen increased demand due to global shipments of Covid-19 vaccines. In summary, the global air cargo capacity in the first quarter of 2021 has been 25% lower than last year.

Aggressive inventory practices have made many manufacturers vulnerable. As vehicle sales began to rebound in the third quarter, automakers were slow to order more semiconductors and lost ground to more agile electronics manufacturers that enjoyed greater visibility into the big picture and strong relationships with customers. semiconductor manufacturers. Electronics manufacturers planned accordingly and secured their supply lines by November 2020.

The auto industry is undergoing another critical market shift that has major supply chain implications: As automakers increasingly prioritize electric vehicles, cars are becoming electronic devices. This means that the automotive industry must now face the competitive demands of all other industries, including those in electronics and those that add Internet connectivity to their products. What has become clear as a lesson is that a flexible and agile supply chain is crucial to be able to move properly when sensitive changes occur and thus protect the business.]]>